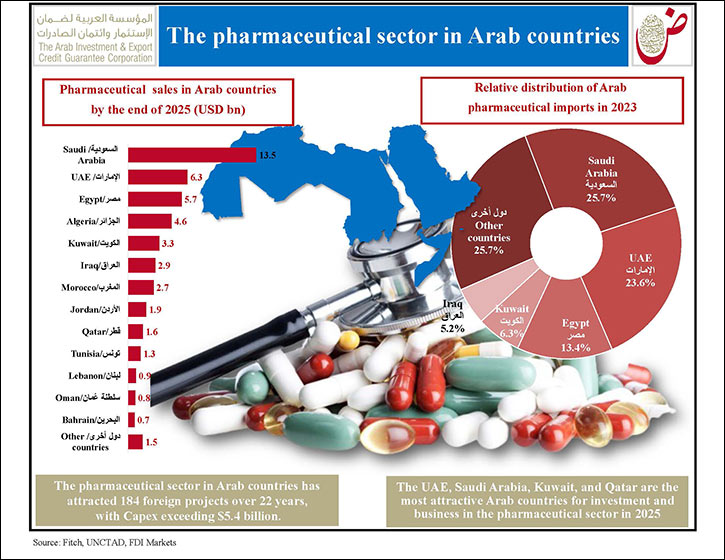

"Dhaman": The Arab pharmaceutical sector attracted 184 foreign projects with Capex exceeding $5.4 billion over 22 years

- The Arab region's pharmaceutical sales are expected to exceed $59 billion by 2030

- UAE, Saudi Arabia and Kuwait are the region's most attractive in investment and business in the pharmaceutical sector during 2025

Please, use the following images:

- The cover of the sectoral report

- The attached diagram

State of Kuwait: 3-6-2025

The Arab Investment & Export Credit Guarantee Corporation (Dhaman) revealed that the Arab pharmaceutical sector attracted 184 foreign projects with Capex of more than $5.4 billion and created over 25000 new jobs, during the period from January 2003 to December 2024.

In its first sectoral report for 2025 regarding the Arab pharmaceutical sector, issued from its headquarters in the State of Kuwait today, the Corporation said that four Arab countries, namely UAE, Saudi Arabia, Algeria and Egypt attracted 141 foreign projects with a share of 77% of the total with Capex of around $3.9 billion, making up 71%. These projects created some 18600 new jobs with a share of 74% of the total.

The report is based on four main pillars: I- evolution and future of pharmaceutical sales until 2030, II- foreign trade for 2023, III- FDI projects in the pharmaceutical sector, IV- assessment of investment and business risks in the pharmaceutical sector during 2025. It showed that the UK led the region's list of investors in terms of Capex, with 26 projects during the period from 2003 to 2024 with Capex of $811 million and more than 3000 new jobs.

It indicated that the top 10 companies held about 26% of newly implemented projects, 48% of the Capex and 49% of new jobs overall. Britain's AstraZeneca and France's Sanofi came in the lead in view of foreign pharmaceutical projects (nine projects each, making up 5% of the total), as Egypt's Pharma Overseas led the list in the Capex ($500 million or 9%). South Korea's Rafa Industry Company ranked first in number of jobs (3000 jobs or 12%).

It added that six Arab countries, notably Saudi Arabia, Kuwait, UAE, Egypt, Jordan and Morocco, invested in 25 inter-Arab projects in the pharmaceutical sector, accounting for roughly 14% of its total foreign projects over 22 years, with their Capex exceeding $1.6 billion, or roughly 30% of the total, and creating over 5000 new jobs, implemented by 23 Arab companies.

Based on Fitch's assessment of risks and rewards of investment and business in pharmaceutical sector in 14 Arab countries through two main indicators risks and rewards, UAE, Saudi Arabia, Kuwait and Qatar came in the forefront as the most attractive Arab countries in the pharmaceutical sector. They were followed by Morocco, Bahrain, Algeria and Egypt respectively.

The report expected the pharmaceutical sales of 19 Arab countries to rise by 5% to roughly $48 billion by the end of 2025, and to keep surging to exceed $59 billion by 2030. It noted that pharmaceutical sales are geographically concentrated in 5 countries: Saudi Arabia, UAE, Egypt, Algeria and Kuwait by holding 70% of the Arab region's total pharmaceutical sales by the end of 2025.

It also forecasted pharmaceutical sales per capita in Arab countries to go up by 2.8% to exceed $197 by the end of 2025.

The ratio of pharmaceutical sales to the Arab GDP is projected to drop to around 1.4% by the end of 2025, and could keep falling to 1.3% by 2030, it said, expecting the share of pharmaceutical sales in the region's total health spending to decline to about 27% by the end of 2025, and to keep dipping to roughly 23% by 2030.

The report added that the Arab countries' pharmaceuticals trade increased by 10.5% to $23.4 billion in 2023, with five countries: UAE, Saudi Arabia, Egypt, Kuwait and Jordan having acquired 74% of the total. Still, Arab pharmaceutical exports are still modest though they increased by 20% to $3.9 billion in 2023, compared to their imports, which rose by 9% to $19.5 billion. So, the pharmaceutical trade deficit exceeded $15.5 billion in 2023.

The report noted that the region's top 10 exporting countries made up around 68% of its overall medicine imports at a value of $13.3 billion, with Germany leading the list with $2.5 billion. The region's top 10 importing countries (including nine Arab countries) held 71% of its overall exports at a value of more than $2.7 billion, with Saudi Arabia coming as the top importer with more than $500 million or 14% of the total.

Based in Kuwait, the Arab Investment & Export Credit Guarantee Corporation (Dhaman) was established in 1974. It comprises as members all Arab countries and four joint Arab financial institutions. It provides specialized insurance services against credit and political risks with a view to facilitating the inflow of foreign direct investments into Arab countries and promoting Arab exports and imports.

Home >> Local News and Government Section

SHEGLAM's Guide to Summer Hydration

KIB Group reports net profit of KD 14.8 million for H1 of 2025

HKTDC to Create Boundless Business Opportunities with Four Major Trade Fairs in ...

Mala Brings Modern Kuwaiti Flavours to Sabah Al Salem The popular homegrown conc ...

The Excitement Continues at Mercato This DSS: Unmissable African Circus Performa ...

OMEGA Marks The Moon Landing Anniversary

Islamic Development Bank Institute and Prince Mohammed Bin Salman College of Bus ...

ATM outlines why luxury hospitality leaders view personalisation as key to reven ...

Ooredoo Kuwait Enhances “Passport” Roaming Plans, Now Covering Over 80 Countries ...

KIB promotes Naser Al-Qenai to General Manager of the Facilities Administration ...

Ministry of Finance and Federal Tax Authority Announce Amendment to Excise Tax o ...

Tonda PF Sport Chronograph Rose Gold Sandstone

Novo Nordisk announced the results from the phase 3b STEP UP trial in people wit ...

Casio to Release MR-G Inspired by the World's Largest Frog

The new Taycan and Cayenne Black Edition models

Why Catrice's Blushin' Charm is the One Thing You Need as Your Travel Essential

KIB employees come together to support annual blood drive in partnership with Ku ...

KIB promotes Khloud Al-Salem to General Manager of the Legal Department

IATA Comments on Misguided Solidarity Levy Proposal

Mercato Wows Visitors with Circus Spectacles, Iconic Slide, and Weekly Cash Priz ...