KIB Group's net profits during H1 2024 reach KD 12 million

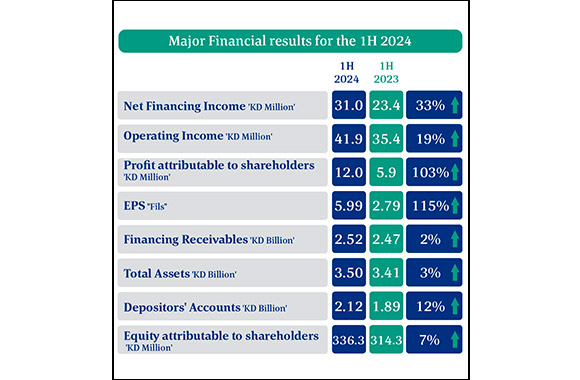

Kuwait, 24 July 2024: Kuwait International Bank (KIB) Chairman Sheikh Mohammed Jarrah Al-Sabah has revealed the financial results for the first half (H1) of the year, which ended on 30 June 2024. During this period, KIB achieved KD 12 million of net profit attributable to shareholders, (i.e. 103% growth) with earnings per share (EPS) standing at 5.99 fils.

Commenting on the results, Al-Jarrah asserted that KIB delivered an outstanding financial performance during the first six months of 2024. He said: “The financial results reflect the strength of the Bank’s financial position, its flexible business model and its ability to achieve sustainable profits. This success is attributed to KIB’s effective strategy, its digital infrastructure investments and its efforts to attract the best national talents.”

Al-Jarrah added: “The financial results recorded during the first half of the year 2024 confirm that the Bank enjoys a strong and stable capital base, enabling us to pursue further development, enhance our digital capabilities, evolve our innovation-driven operations and expand our financing and investment activities on different levels.” He also noted KIB's readiness to participate in financing various development projects in Kuwait.

Delving into the Bank’s interim financial statement for H1 2024, Al-Jarrah stated that KIB’s total assets grew to reach almost KD 3.50 billion, this growth was the result of an increase in the size of financing portfolio to reach KD 2.52 billion as at 30 June 2024. In addition, he noted that KIB’s investment and high-quality Sukuk portfolio stood at KD 405 million.

Al-Jarrah highlighted that depositors’ accounts witnessed a growth by 12% to reach almost KD 2.12 billion at the end of 30 June 2024. In addition, the shareholder equity, stood at almost KD 336 million (i.e. 7% growth) due to KIB successfully maintaining adequate levels of Basel III total capital adequacy ratio, which was 19.5% at the end of H1 2024.

On his part, KIB Vice Chairman and CEO Raed Jawad Bukhamseen pointed out that KIB has maintained sustainable profit growth and continued to achieve positive financial results thanks to its long-term strategy to keep pace with the banking sector’s rapid and continuous advancement, with a core focus on innovation, transformation and agile development. “Our continuous efforts aim to achieve our mission of providing an exceptional banking experience for our customers, ensuring the application of best responsible banking practices and risk management, while committing to providing added value to our shareholders,” he said.

Bukhamseen presented the key financial results for the first half of the year 2024, where financing income increased to reach KD 89 million, compared to almost KD 82 million, with a growth rate of 9% on an annual basis, and net financing income increased to reach an KD 31 million, compared to almost KD 23 million, with a growth rate of 33% on an annual basis, and an increase in fees and commission income to reach KD 7.8 million, compared to an KD 6 million, with a growth rate of 28% on an annual basis, as this contributed to an increase in operating income to reach almost KD 42 million compared to KD 35 million, with a growth rate of 19% on an annual basis for the period ended 30 June.

Bukhamseen highlighted KIB’s notable achievements during the first half of 2024, pointing out that the Bank successfully issued a USD 300 million Additional Tier 1 (AT1) Sukuk at an annual profit rate of 6.625%. The issuance attracted high investor demand, resulting in an oversubscription of over twice the original size of the issued Sukuk. The final pricing represented the tightest spread ever achieved on an AT1 Sukuk globally at the time of issuance, at 195 basis points above US Treasuries. In addition, KIB has fully redeemed the Tier 1 Sukuk issued in 2019 by way of exercising the sukuk Call Option.

Finally, Bukhamseen pointed out that the subsidiaries of the KIB continue to achieve tangible achievements in diversifying and developing products and services, targeting all companies in their various sectors to provide innovative and advanced services.

In their concluding remarks, both Bukhamseen and Al-Jarrah lauded the role of the Central Bank of Kuwait and its continuous support, and expressed gratitude to the Capital Markets Authority for fostering an attractive and competitive investment environment in the State of Kuwait. They also praised the diligent efforts of all teams at KIB and their contributions to achieving these results, expressing their sincere appreciation to KIB’s Board of Directors and its Executive Management for their continuous support and wise guidance towards further strengthening the Bank’s financial position and meeting all requirements related to environmental, social and corporate governance.

Home >> Business & Economy Section

Casio to Release MR-G Inspired by the World's Largest Frog

The new Taycan and Cayenne Black Edition models

Why Catrice's Blushin' Charm is the One Thing You Need as Your Travel Essential

KIB employees come together to support annual blood drive in partnership with Ku ...

KIB promotes Khloud Al-Salem to General Manager of the Legal Department

IATA Comments on Misguided Solidarity Levy Proposal

Mercato Wows Visitors with Circus Spectacles, Iconic Slide, and Weekly Cash Priz ...

Pioneering the Future of Food Tech in Kuwait Jahez Application and Kuwait Innova ...

CINET Launches a Cybersecurity Internship Program to Empower a Future-Ready Work ...

Burgan Bank Signs Partnership with SAP to Deploy the SuccessFactors HCM System

G-SHOCK's Summer Style Statement: Metal-Cased Watches That Define the Season

Passenger Growth Hits 5% in May

May Air Cargo Demand Up 2.2% Despite Trade Disruptions

KIB promotes financial awareness and banking literacy among visitors of Assima M ...

Hibrid and Alibaba Cloud Sign MoU to Deliver Advanced Streaming and Comprehensiv ...

Get Ready for Fabulous Summer Looks with BADgal BANG! Power Blue Mascara!

Burgan Bank Appoints Mohammed Al-Roomi as Deputy General Manager of Information ...

KIB signs strategic partnership with IE Business School under Waed program

Bigger Thrills and Better Rewards Await You This Dubai Summer Surprises at Merca ...

KIB hosts a panel discussion titled ‘Financing and Mortgages: Opportunities and ...