• Arab Countries Increased its Foreign Currency Reserves to Surpass $1 Trillion with Debt Index Improvement

State of Kuwait: 11/1/2024

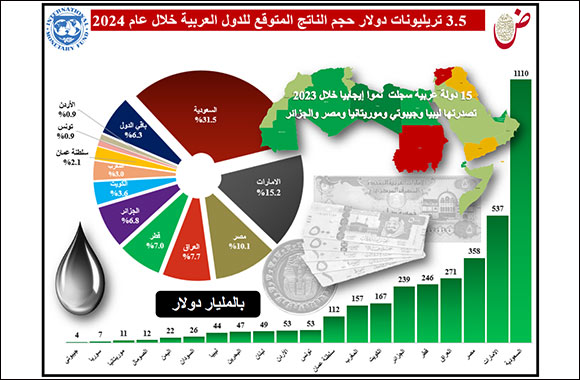

The Arab Investment & Export Credit Guarantee Corporation 'Dhaman' revealed that Arab GDP grew by 1.8% to reach about $3.4 trillion in 2023, according to International Monetary Fund (IMF) estimates in October 2023, in conjunction with the growth of the global economy by 3% in 2023.

The Director General of 'Dhaman', Mr. Abdullah Ahmad Al-Sabeeh, explained in the editorial of the fourth quarterly bulletin for 2023 that the overall outlooks of the Arab economy came positive for 2024, with an expected growth rate of %3.6, buoyed by the potential growth of 9 oil exporters that account for 78% of the Arab GDP, which could make up the downturn of other economies.

Al-Sabeeh attributed the decline in the performance of most Arab economic indicators in 2023 to several reasons, including the decrease of oil production by 5.2% and global crude oil prices by 16.5%, the negative effects of tightening monetary policies and lending criteria and the escalation of the geopolitical situation, the debt crisis and climate change, as follows:

• The average GDP per capita in Arab countries dropped by 4.7% to reach $7,482, with estimations to increase by 1.2% to hit an average of $7,573 in 2024. While the average GDP per capita according to the purchasing power parity (PPP) rose by 3.2% to reach $18.1 thousand in 2023, with continued significant disparity between oil exporters and other lower-income countries.

• The Arab population grew by 2% to exceed 456 million in 2023, and the average of the unemployment rate increased to 9.4% in the same year.

• The average rate of consumer prices inflation in the Arab region rose to 12.1% in 2023, with expectations that it will decline to 11.7% in 2024.

• The combined default surplus for Arab government fiscal balance fell to reach $3.3 billion in 2023, with expectations to turn into a deficit of $26.9 billion in 2024 to represent 0.8% of the Arab GDP.

• The Arab debt indicators improved, as the government debt ratio stabilized at 47% of the Arab GDP, with estimates to decrease to 46.1% in 2024. In addition, the external debt ratio declined to 50.8% of the Arab GDP in 2023, and it is expected to reach 49.6% of the Arab GDP in 2024.

• Arab foreign trade in goods and services dropped by 5.7% to less than $3 trillion in 2023, due to the decrease of Arab exports by 9.7% and imports by 0.4%. Thus, the trade balance surplus declined by 39% to reach $262 billion in the same year.

• The current account surplus of Arab countries decreased by 52.3% in 2023 to reach $180 billion, representing 5.3% of the Arab GDP, with forecasts to reach $157 billion in 2024, representing 4.4% of the Arab GDP.

• Arab gross official reserves surpassed $1 trillion, enough to cover Arab imports of goods and services for 8.6 months, with predictions to exceed $1.1 trillion in 2024.

Al-Sabeeh said that despite the optimistic outlooks of the IMF regarding the Arab economy, this optimism depends on the scenarios of the war on Gaza and its impacts on the global oil prices and on the economic and political situations of the neighboring countries, along with the effects of the important presidential and legislative elections scheduled to take place in about 40 countries during 2024, especially with the possible change in the USA and UK, besides the repercussions of the political, economic and climate developments on the region situation.

In this context, 'Dhaman' will continue to support trade and investment in the Arab region by providing its insurance services against political and commercial risks, to maximize the benefits of the member states and the peoples of the region.

Based in Kuwait, the Arab Investment & Export Credit Guarantee Corporation (Dhaman) was established in 1974. It comprises as members all Arab countries and four joint Arab financial institutions. It provides specialized insurance services against credit and political risks with a view to facilitating the inflow of foreign direct investments into Arab countries and promoting Arab exports and imports.

.