KIB Group records KD 19 million profits for the year 2023, 40% up from last year

Total assets amounted to KD3.62 billion

Financing portfolio amounted to KD2.49 billion

Depositors' accounts amounted to KD2.12 billion

Net profit attributable to shareholders achieved 40% growth

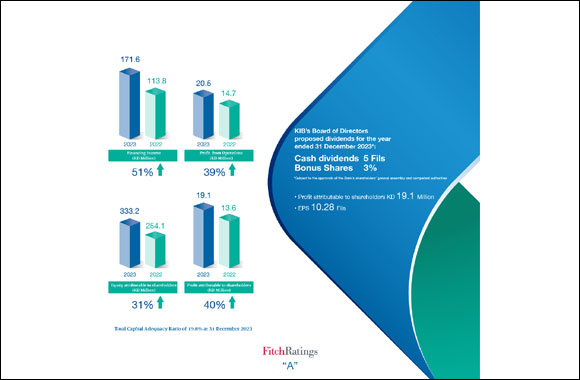

Kuwait, 26 February 2024: The Chairman of Kuwait International Bank (KIB) Group, Sheikh Mohammed Jarrah Al-Sabah, announced the Bank’s financial results for the year ending on 31 December 2023, highlighting that KIB achieved a net profit attributable to shareholders of KD 19 million, marking a 40% increase over the last year, with earnings per share (EPS) of 10.28 fils. Meanwhile, total operating income increased by 16% over 2022, reaching approximately KD73 million in 2023.

Commenting on the latest financial results of KIB, Al-Jarrah confirmed the steadiness of its sustainable growth trajectory, which reflects the strength of its financial position, the success of its strategy implementation, and the flexibility of its business model to enhance its status as one of the leading banks in the State of Kuwait. Throughout the year, the Bank continued to innovate and offer new banking products and services in response to its customers’ needs, providing them with exclusive benefits and digital solutions that are in line with their modern lifestyles.

As for the financial performance during 2023, the financing revenues witnessed a 51% growth, amounting to KD172 million, in comparison to approximately KD114 million that was achieved in the previous year. Investment income also recorded a 13% growth amounting to KD6 million, in comparison to approximately KD5 million that was recorded in the previous year.

He further noted KIB’s continued efforts towards improving its asset quality metrics. The total assets amounted to KD3.62 billion while the Bank’s financing portfolio reached KD2.49 billion. Investment portfolio grew to reach approximately KD363 million by 31 December 2023, supported by increase of investments in high-quality Sukuk.

Al-Jarrah added: 'KIB has a strong financial standing as well as a solid and stable capital base, which contributes to supporting its efforts to meet the growing needs of its customers, alongside achieving the best returns for its shareholders,' confirming the Bank's commitment to expanding the scope of its financing and investment activities, on the local, regional, and international levels, through participation in syndicated financing deals, among others, in cooperation with its customers across various sectors.

Regarding dividends’ distribution among the shareholders, Al-Jarrah stated that KIB’s Board of Directors proposed cash dividends of 5 fils per share, in addition to 3% as bonus shares from the issued and paid-up capital, subject to the approvals of the Bank’s shareholders’ general assembly and competent regulatory authorities.

He also referred to KIB's strategy of relying on adopting a flexible operational model and an approach that keeps pace with the continuous developments in the banking sector and adapts to its changes, indicating that the Bank's main business sectors performed well during 2023 and recorded further momentum in operational performance. He confirmed the Bank's continued investment in technological infrastructure and the enhancement of its digital services in line with its digital transformation strategy, thereby maintaining its leadership and competitive position in the banking sector.

Commenting on the financial results of 2023, Raed Jawad Bukhamseen, Vice Chairman and Chief Executive Officer of the Group, said: “The growth in KIB's profitability coincides with strengthening the Bank's financial position, in addition to the comprehensive and sound hedging policies for risk management and the reliable and proven approach to crisis management.”

In his statement, Bukhamseen noted the increase in the net financing income by 21% to reach KD53 million, in comparison with the approximate KD44 million that was achieved in the previous year. Depositors’ accounts exceeded KD2 billion as of 31 December 2023. Meanwhile, shareholders’ equity grew by 31% to reach KD333 million as of 31 December 2023. He further noted that KIB maintained adequate levels of Basel III, and the total capital adequacy ratio stood at 19.78%.

Bukhamseen added: 'The year 2023 witnessed the successful increase in KIB’s share capital, in line with the Bank's adoption of a digital transformation strategy and the fundamental plans it encompasses, and the efforts aimed at modernizing the business model, enhancing sustainable growth indicators, and achieving further development. KIB completed the capital increase subscription process successfully in June 2023, by offering 428,571,429 shares valued at KD 60 million. The Bank’s paid-up capital increased by 34.98% to reach KD 165.4 million. The rights issue was oversubscribed by 687%, reflecting the shareholders' and investors' confidence in KIB's dynamic strategy and future vision.'

On the digital front, Bukhamseen pointed out that, last year, KIB unveiled three new, advanced digital platforms: the first-of-its-kind digital real estate platform, KIB Aqari; the all-new and revamped Corporate Online Banking platform; and the upgraded and improved version of the KIB Mobile application. This affirms the Bank's commitment to keeping up with the latest digital innovations and its expansion plan in digital banking services and products, in order to meet all customer needs in a more comprehensive, efficient, and secure manner.

On another note, Bukhamseen referred to the official opening of 'KIB Mubader Center' to support the entrepreneur segment of small and medium-sized enterprise (SME) owners, in addition to the founding of KIB Invest, the investment arm of KIB, with a capital of KD 45 million, which centers its activities on Islamic investment and providing a comprehensive suite of investment services that fulfill the needs and aspirations of the Bank’s customers within the domestic and global markets, which is delivered by a highly qualified and competent team.

Bukhamseen further noted: “The establishment of a new company comes as part of KIB’s continued efforts to reinforce its pivotal role in vitalizing the domestic capital market and providing its customers with outstanding investment opportunities. It also comes as part of the Bank’s endeavors to attract more investors to its customer base, offering them diverse and thoroughly thought-out investment options that guarantee maximum returns with minimum risk.”

Social Responsibility

KIB is among the driving forces behind one of Kuwait’s most profound and comprehensive social responsibility programs across the banking sector’s major institutions, renewing, under its umbrella, the Bank’s commitment to environmental, social, and governance (ESG) policies and practices. The Bank’s commitment to the ESG guidelines is but an extension to its determination to play an active role in the wide-scale development of society across diverse fields, enabling the Bank to benefit as many segments of society as possible.

Within this context, KIB commenced 2023 by renewing its continuous support for the banking awareness campaign ‘Let's Be Aware’ (Diraya) for the third consecutive year, launched by the Central Bank of Kuwait (CBK) and the Kuwait Banking Association (KBA) in cooperation with local banks. The Bank focused on selecting strategic locations, such as busy malls, to reach the largest segment of the community, in addition to continuing to disseminate its awareness messages through media platforms and its digital banking channels.

Moreover, KIB was keen on taking effective steps to enhance the sports and social culture in the State of Kuwait by sponsoring various sporting and social events.

KIB also published its second Annual Sustainability Report for 2022, through which it renewed its commitment to its clear and focused initiatives and efforts in applying and integrating Environmental, Social, and Governance (ESG) principles across all its banking operations and activities.

Awards and Honors

Bukhamseen lauded the Bank for receiving numerous prestigious awards during 2023, confirming its continued progress and significant achievements in the field of Islamic finance and social responsibility. KIB garnered several awards from World Finance magazine, including the 'Best Islamic Bank in Kuwait for 2023' award, for the tenth consecutive year, and the 'Best Customer-Focused Islamic Banking Products and Services in Kuwait' award, for the third consecutive year. World Finance also honored KIB's leadership, where the Bank's Chairman, Sheikh Mohammed Jarrah Al-Sabah, once again received the 'Life Achievement in Islamic Banking and Dedication to Community' award. Meanwhile, Vice Chairman and CEO, Raed Jawad Bukhamseen, garnered the 'Kuwaiti Visionary CEO – Development and Growth Driver' award for another year.

KIB also won several awards from Capital Finance International (CFI.co). For the third year running, KIB secured the 'Best Banking Vision - MENA 2023' award, as well as the 'Best Sharia-Compliant Bank - MENA' by the magazine for the year 2023. CFI.co also named KIB the 'Best Bank in Financial Literacy Program - MENA 2023'.

KIB was also named the 'Best Bank in Kuwait in Terms of Spreading Financial Literacy and Banking Awareness in 2023' by the World Union of Arab Bankers. In addition, KIB was recognized in the first-ever Qorus Reinvention Awards – MEA, which put the spotlight on the institutions that are innovating at scale to shape the future of financial services in the Middle East and Africa region. The Bank’s innovative KIB Aqari, which offers the first-of-its-kind real estate digital platform in Kuwait, won an award under the 'Distribution' category.

Home >> Banking & Investments Section

KIB introduces the best financing offer on the new KIA Seltos through KIB PayTal ...

KIB Issues USD 300 Million Additional Tier 1 Sukuk

Burgan Bank Launches Its Investment and Wealth Management Academy in Collaborati ...

KIB Organizes the First Partners and Suppliers' Forum in Kuwait

Ogilvy Appoints Antonis Kocheilas Global Chief Transformation Officer

KIB Mubader Center launches ‘E-Cothon' digital commerce competition

SAP Appoints New Managing Director for Kuwait

KIB announces winners of Al Dirwaza account's weekly draw April 2024

Burgan Bank Sponsors Free Jabriya's Latest Musical Festival “Macintosh”

KIB offers the best financing offer on Nissan Patrol models through KIB PayTally ...

Ooredoo Kuwait confirms its leadership in supporting sustainability solutions on ...

Hysek reveals iconic timepieces at Watches & Wonders 2024

KIB recognized as ‘Best Bank in Financial Literacy Program MENA' by CFI.co

Burgan Bank Continues Its Support for KACCH & BACCH for the 23rd Consecutive Yea ...

Khabib's Official Training Gloves Will Be Sold at Tooba Charity Auction in Dubai

Burgan Bank Sponsors the Bristol Rovers Football Academy

Porsche Centre Shuwaikh unveils the 2024 Panamera

Burgan Bank Adds Birthday Leaves to Employee Benefits

Burgan Concludes Sponsorship of Kuwait Equestrian Federation's 2023/2024 Tour

KIB shares Iftar meal with security guards as part of its Ramadan campaign